unfiled tax returns reddit

I had unfilled taxes from 2009 to 2016. Unfiled tax returns could result in charges with tax evasion by both the IRS and your state tax agency.

Refundtalk Where S My Refund Tax News Information

However you may still be on the hook 10 or 20 years.

. You need to understand that is the one of the most basic tax requirements. Dec 19 2019 there are two essential concepts in the 2017 tax cuts and jobs act that change the way business losses are handled on tax returns. The IRS generally wants to see the last seven years of returns on file.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. An irs tax attorney can help you figure out the best way to. Log In Sign Up.

Unfiled Tax Returns. The good news is that there are many potential ways to resolve the issues surrounding unfiled tax returns. Posted by 6 minutes ago.

If your return wasnt filed by the due date including extensions of time to file. I am a bit. In fact the fine for missing a filing deadline called a Failure-to-File penalty is higher than the Failure-to-Pay.

California FTB Unfiled Tax Returns - How They File For You Explained by a Tax Attorney. Hello Im almost ready to apply for my CPA license with all exams passed in NY. If you have old unfiled tax returns it may be tempting to believe that the IRS or state tax agency has forgotten about you.

10 years of unfiled tax returns. Not filing is a very serious matter. Any information statements Forms W-2 1099 that you may.

Bring these six items to your appointment. Send your signed tax return to the address shown on the top of your. Many of our clients seek assistance with filing delinquent or missing tax returns.

Home Unfiled Tax Returns. I need to come. Unfiled tax return preparation is often a central component of income tax controversies and resolution.

The IRS assesses fines for unpaid taxes as well as late or unfiled tax returns. End Your Tax NightApre Now. If you fail to file your taxes by the designated deadline usually April 15 you will be assessed a late filing penalty equal to 5 of the tax due for each month it remains unpaid.

5 Unfiled 1120S returns. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. A copy of your notices especially the most recent notices on the unfiled tax years.

He told me once. 10 years of unfiled taxes. Ad 5 Best Tax Relief Companies of 2022.

Jan 31 2022 due to. Posted by 6 months ago. 5 years of 900month in income on the rental all the 1099 capital gains on any dividendsno deductions and thats after all the W2 stuff.

Skip to main content. Once the return is processed you will receive a notice with the balance due including penalties and interest after about 8 weeks. Posted by 4 years ago.

5 Unfiled 1120S returns. They were recently done by a tax pro I was referred to. Based on income thats probably all under the.

If the IRS filed for you youll want to replace the Substitute for Returns with returns of your own to. Not filing is the. 10 years of unfiled taxes.

Even if you have a more extensive or complex tax. Log In Sign Up. Total bill is about 13k.

Part of the reason the IRS requires six years is manpower the IRS cannot administer and staff the enforcement of unfiled tax returns going back as far as 10 or 20. If you owe on any return file it as soon as possible. You start by collecting all your W-2s 1099s and any other income documents you have.

Passport unfiled taxes. Passport unfiled taxes. However I ironically have a few years of tax returns that I didnt submit mostly because I was.

If you dont have some go to IRSgov set up an account request transcripts for incomewages. Tax evasion doesnt just apply to Federal Income taxes. She works in the service industry with one main job a 1099 some years and cash side.

This has led to many taxpayers receiving erroneous notices from the IRS CP-80 stating. My friend asked for help with her tax returns has never filed. We just mailed all the returns.

News video on One News Page on Monday 4 April 2022. Our expat tax software and Streamlined Procedure service has one of the most affordable packages for Americans abroad.

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Irs To Suspend Mailing Additional Letters Afsg Consulting

Can The Irs File A Return For Me Yes But It S Not Pleasant H R Block

Can I Go To Jail For Unfiled Tax Returns Tax Resolution

Immigration And Lying On Your Tax Return The Quickest Way To Deportation Verni Tax Law

What Happens If I Don T File My Tax Returns Taxwatch Canada Llp

Unfiled Tax Returns Tax Lawyer Serving Clients Nationwide We Solve Tax Problems

Unfiled Past Due Tax Returns Faqs Irs Mind

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Mis Tax Pros Disclaimer Us Tax Tax Helpful

When Does The Irs File A Tax Lien

I Received This Letter Today From The Irs I Talked To The Tax Advocate Thursday R Irs

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

How Can I Reduce My Irs Penalties And Interest

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Can The Irs Take Or Hold My Refund Yes H R Block

The Impact Of Unfiled Tax Returns On Your Security Clearance

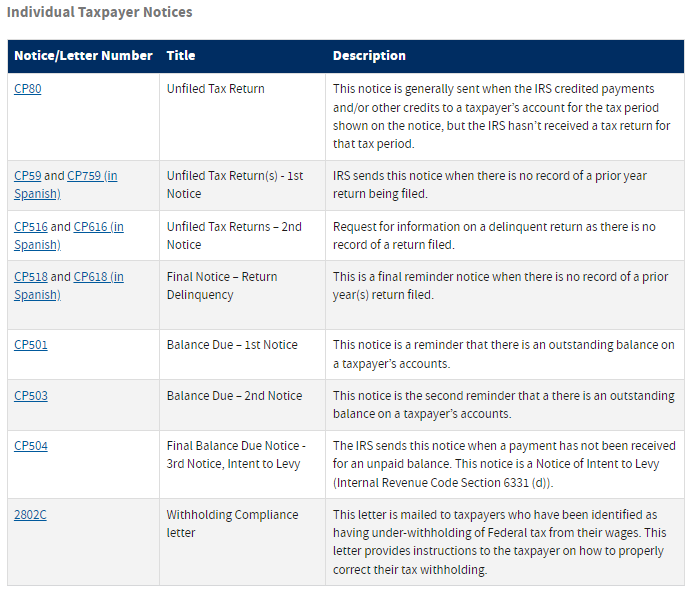

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block